Articles

Immediately after an appartment time frame your $a hundred totally free processor tend to end. https://mrbetlogin.com/night-at-ktv/ Extremely 100 percent free chips offers ranging from 2 and you may 1 week in order to complete the remaining terms and conditions. Once tinkering with Bitstarz, we could finish that crypto casino happens laden with all the fresh benefits you ought to have a complete iGaming experience with Bitcoin. Harbors from the largest developers on the market and you will a great number of bonuses that could produce several thousand dollars worth of Bitcoin is right here to your getting. Having less a devoted mobile application and you will sportsbook you’ll get off particular profiles searching for much more.

El mas grandioso local casino con el fin de tragamonedas clásicas

The newest Hold & Spinner twist will give you the chance to win quick coin awards as well as free spins. That have colorful artwork and fascinating retriggers, it’s best for $step 1 put participants thanks to their lowest minimal share and you will satisfying gameplay. Understanding the ins and outs of using real cash, even as nothing as the $1, is very important for making advised choices and you will increasing your gaming feel. Betting conditions, such as, are often higher than those people for other promos, as well as the incentives themselves would be reduced otherwise limited by particular games or headings. I’m in addition to a fan of the brand new eight-height consumer support system you to’s truly satisfying for very long-term Katsubet profiles at all like me.

For those who alter the usage of a car out of one hundred% private use to organization have fun with inside taxation year, you will possibly not has distance info for the date before the switch to team fool around with. In such a case, you contour the new percentage of company explore to the seasons since the follows. To find depreciation within the straight-line approach, you must decrease your basis in the automobile (although not less than zero) from the a flat rates for each mile for everybody miles in which you utilized the simple distance rates. The rate for each mile may vary with respect to the year(s) your utilized the standard distance rate. On the rate(s) to use, discover Decline modifications once you made use of the standard mileage rates under Disposition of a vehicle, later on. To possess purposes of figuring depreciation, if you first start by using the vehicle simply for individual fool around with and later transfer they to help you team play with, you put the vehicle in service to the time from sales.

What You casinos on the internet give incentives with a great $1 lowest put?

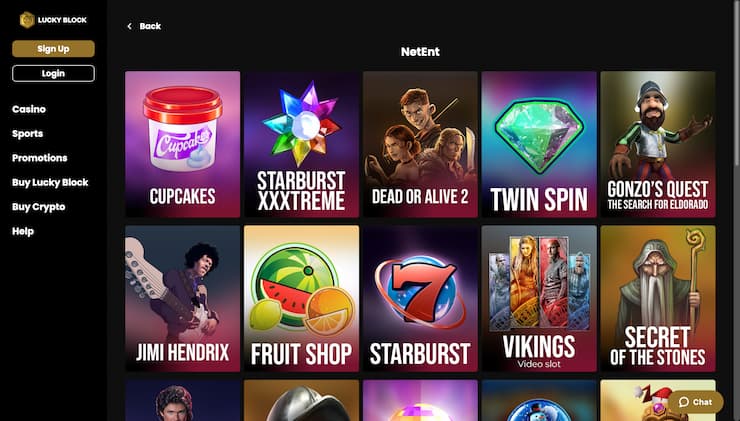

Whether your’re on the slot machines otherwise classic desk game such as web based poker and you can blackjack, All the Slots features all of it. The working platform is actually authorized because of the Curacao and contains become where you can find Canadian bettors because the its inception inside 2014. Clients is also gain to C$5000 while the incentive money immediately after enrolling, that is somewhat ample.

Discover Reduced-Stake Game with high Earnings

Extent actually starts to phase aside when you yourself have modified AGI in excess of $252,150 which is completely phased out should your changed AGI is actually $292,150 or even more. Explore Setting 7206 and its particular guidelines to decide any number of the fresh notice-working health insurance deduction you are in a position to claim and report on Schedule step one (Mode 1040), range 17. The brand new credit to possess accredited sick and members of the family hop out earnings paid-in 2023 to possess get off removed before April step one, 2021, as well as hop out pulled after March 31, 2021, and you can before October 1, 2021, are in reality said to the Agenda step 3, range 13z. When you have a cost of your own borrowing for new otherwise previously owned clean car stated to the Mode 8936 and Schedule A (Mode 8936), those people quantity tend to today be said for the Schedule dos (Function 1040), traces 1b and 1c. Significant sites within the Karachi tend to be a number of important galleries. Quaid-e-Azam Household, the fresh house out of Muhammad Ali Jinnah’s home, in addition to serves as an art gallery exhibiting their furniture and other belongings.

Armed forces to the a long-term duty project to another country, you aren’t travelling on the go. You might’t subtract this type of expenditures even if you need to look after a great household in the us for your needs players just who aren’t allowed to supplement your overseas. If you are transported from permanent duty station to a different, you have got deductible moving expenditures, which are said within the Club. To own income tax objectives, travelling expenditures is the ordinary and you can expected expenses of travel away at home to suit your needs, profession, otherwise work. The fresh Wells Fargo Informal Checking account is recommended while the better discover for the best bank sign-upwards extra.

Interest on the Refunds

These types of laws disagree according to whether the plan try a defined share bundle otherwise an exact work with bundle. Starting with withdrawals produced once December 29, 2023, a shipment to help you a domestic discipline sufferer isn’t susceptible to the newest 10% more taxation on the very early withdrawals if the certain requirements is fulfilled. Basically, when you yourself have money of discussing discount deals, or if you performed concert performs, you should is all earnings acquired whether or not you received an application 1099-K, Fee Cards and you may 3rd-People Community Purchases, or perhaps not. Understand the Instructions for Agenda C (Mode 1040) and the Guidelines to have Schedule SE (Mode 1040). Scholarship prizes obtained within the an event aren’t grants otherwise fellowships if you don’t need to use the new awards for educational motives. You need to is these types of number in your income to your Schedule step 1 (Mode 1040), line 8i, even when you employ the brand new numbers to possess informative objectives.

Increase Dream Incentive Offer

This is the laws even in claims which have community possessions regulations. You can unlock different kinds of IRAs which have many different organizations. You can discover a keen IRA at the a lender or any other monetary institution otherwise that have a shared money otherwise life insurance organization. Military, your own compensation boasts one nontaxable handle shell out you can get.

You will want to are the numbers revealed to the the Models SSA-1099 and you can Variations RRB-1099 you can get for the year to determine the full amounts gotten and paid back, and taxes withheld for that season. Setting 1099-INT, package 4 often contain an amount if perhaps you were subject to duplicate withholding. Are the matter of package cuatro to your Form 1040 otherwise 1040-SR, range 25b (government income tax withheld). Setting 1099-INT, box step three reveals the attention earnings you received from U.S. savings ties, Treasury debts, Treasury notes, and you can Treasury securities. Essentially, add the matter shown in shape 1099-INT, box step three to the other nonexempt interest earnings you obtained.